Here in Killeen, there are a LOT of foreclosures, even though the market is fairly neutral (6 months’ inventory).

A major reason in my opinion is the prevalence of the VA loan in our community.

The VA loan is a great loan program when responsibly taken advantage of. It offers a loan with no down payment, no mortgage insurance, and rates that are often better than the other loan options available. Most Service Members would do well to take advantage of the program when they are ready and in a position to buy.

But the program also comes with a downside. Because of the 100% financing and the fact that most buyers finance the VA funding fee into the loan, it literally means that buyers with the VA loan are underwater on their home from Day 1, usually by a few thousand dollars. That does not even include the enormous transaction costs of selling a home.

An example:

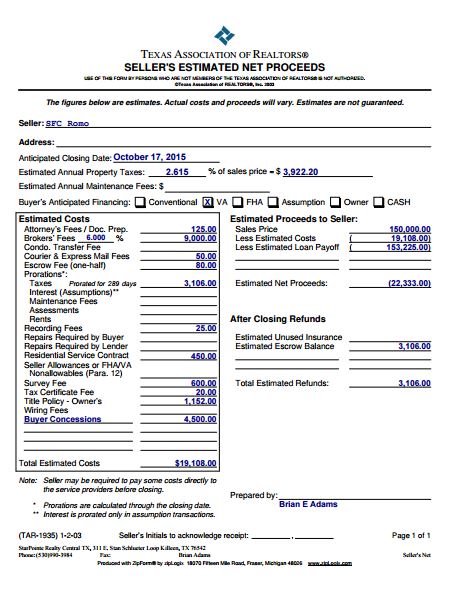

SFC Romo purchases a home for $150,000 in Copperas Cove. The home is worth $150,000, but they also finance the VA funding fee of $3225 for a total loan of $153,225.

If SFC Romo were to turn around in our current market and try to sell that same home the next day, his net sheet in our current market would probably look something like this:

So even if he got a full price offer for exactly what he paid for his home, $150,000, he would only see $130,892 of that. But he owes $153,225, meaning he would have to PAY $22,333 to sell his own home.

It will at least be several years waiting to pay down equity or hoping market prices rise before SFC Romo could break even.

Many Soldiers’ financial situations change, they find that they bought more house than they could keep up with, and find that they can’t sell it without bringing a lot of money to the table. That is why there will always be plenty of VA foreclosures in military towns like Killeen.

Not just the VA loan, but homes that have loans with high loan-to-value ratios like Conventional, FHA and USDA are seldom good options if you think you may have to sell the home only a few years after purchasing it.

Again, the VA loan is a GREAT tool for unlocking homeownership and getting out of putting rent into someone else’s pocket. But like any tool, it still must be used responsibly.